Economic News Brazil/Regional News

The main purpose of this page (News Brazil – News and Developments) aims at providing clients and visitors of this homepage a variety of recent information and newspaper/journal articles about Brazil´s economic, agricultural and real estate environment and performance, as well as regional information (general developments, tourism highlights, infrastructure etc. in relation to the diverse states and administrative entities of Brazil). Different from the literature page (https://real-estate-brazil.com/literature/), which contains more general and in-depth academic analysis, monographies and essays, this section focusses rather on new and recent developments. The second part, Regional News, will be structured into news for the different Brazilian states and regions (Rio de Janeiro, Bahia, Tocantins etc.)

Short abstracts and summaries about recent economic and infrastructural developments below will be accompanied by corroborating links of Brazilian and International Media, mostly journal news, but also topic related publications and even at times short videos and documentaries. Economic developments have, per se, a profound impact on the real estate market and the political and economic framework serves as a confidence framework, in terms of stability of expectations and security of investments. Each investor is well advised to keep these developments in mind when it comes to proper diligence processes.

The articles and single news cover, in average, the last 6 years – starting from 2020 to the present (as of February 2026). A six year time frame provides also a good overview of recent developments, showing evolution and changes in the overall political and economic setting without losing actuality. It reveals trends and path-dependencies.

Information: Real Estate Brazil holds on a regular basis workshops with the topic “The property market in Brazil – opportunities, risks and modalities of purchase”, which include also individual presentations of sustainable real estate. The next workshop will take place in the time between the 02nd of march to the 30th of april 2026, the 15th installment of its kind. Dr. Andreas Hahn as referee and speaker will hold seminars at the Chamber of Commerce in Berlin and Expo Center Norte (AHK/Fiesp) in São Paulo. Interested parties are invited to participate, for inscription and registration please contact us. The events are subsidized by the Chamber of Commerce and Fiesp (Federação das Indústrias do Estado de São Paulo).

You can click on the distinct state tabs below and get re-directed to the proper state-sections, or continue reading below to access general economic and real estate news with a Brazilian-wide relevance:

Alagoas

Bahia

Ceará

Paraná

Rio de Janeiro

Rio Grande do Norte

Rio Grande do Sul

Santa Catarina

São Paulo

Sergipe

1. Economic News Brazil – Updates and Developments in the Economic and Real Estate Sector

03.02.2026: The price of residential properties in Brazil rose 0.20% in January, according to the FipeZAP Residential Sales Index. This result marked the smallest monthly variation since March 2021 and signals a slowdown in the rate of price increases at the beginning of 2026.

13.01.2026: After years marked by high interest rates, credit restrictions, and profound adjustments in supply, 2025 is consolidating itself as a year of transition in the Brazilian real estate market. Regional and macroeconomic data show a common point: demand remained strong, prices grew above inflation, and inventory began to fall. This movement, although still coexisting with a high financial cost, prepares the ground for a new cycle starting in 2026.

Analyzing the country’s main markets, it becomes clear that we are not facing a homogeneous recovery, but rather a more selective, more technical market, and one much more dependent on well-structured capital.

2025: Brazil Macro-Economic Monitor, published by the Ministry of Finance, Secretariat of Foreign Affairs and the Undersecretariat for Macroeconomic Monitoring and Trade Policies. It summarizes the current macro-economic trends and outlooks, focussing on general variables like the unemployment rate or inflation, as well as on more specific topics as the creation of the Forest Conservation Fund or the Progressive Tax Reform.

16.10.2025: As the below article states, the Brazilian economic activity showed growth in August this year, according to information released this Thursday (16) by the Central Bank (BC). The Central Bank’s Economic Activity Index (IBC-Br) rose 0.4% in August compared to the previous month, considering seasonally adjusted data.

18.08.2025: In the first six months of 2025, the real estate market registered growth in both the volume of launches (6.8%) and sales (9.6%), compared to the same period in 2024.

15.08.2025: The article below highlights the current upturn and momentum on the Brazilian real estate market, with annual growth numbers of 7,97 %, including a forecast and also a medium-term outlook.

02.08.2025: Curitiba (PR), Goiânia (GO), and São Paulo (SP) continue to lead the cities with the highest demand for real estate in the second quarter of 2025 in the low-income (up to R$12,000) and mid-income (from R$12,000) segments.

- https://exame.com/mercado-imobiliario/onde-o-mercado-imobiliario-esta-em-alta-as-cidades-com-maior-demanda-segundo-o-novo-idi-brasil/

15.07.2025: Residential rents increased 0.51% in June 2025, a sign of a slowdown after increases of 1.15% in April and 0.59% in May. Accumulated growth in the first half of the year, however, was significant, increasing attractiveness of rental incomes compared to financial investments.

24.06.2025: The Brazilian Central bank announced unofficial that the high interest rate (taxa Selic) will probably maintained for a longer period of time, at 15 %. As written in the article below, also the related commentary, this is the correct policy given the current scenario. Beyond that, it is interesting for many investors in the real estate sector, since potential financial surplus can be applied to risk-free, high return fixed investments (like LCA or LCI) on the long term.

19.06.2025: The Brazilian Central Bank elevated the Selic rate to 15 %, the highest level since 2006. While some analysts pinpoint the disadvantages of a high interest rate regarding the economy (for example increase in financing and credit cost), we believe that the benefits outweigh the shortcomings by far. On the one hand, the Brazilian Central bank is a testament of institutional stability and commitment towards combating inflation – quite the opposite to the European Central Bank (EZB) which, despite sky-rocketing prices and high empirical inflation maintains interest rates proximate to zero. However, most importantly, high interest rates curb inflation, and decrease the general level of indebtedness of the Brazilian populace. A large part of the population is highly indebted due to over-abundance of credit, as well as the “American-style” over-utilization of credit cards. This results in many families falling into precarious situations, depending on exploitative jobs while paying high living costs. Thus, in the long run, high interest rates are absolutely crucial in diminishing inflation as well as the general level of indebtedness and can thus lead to a healther economy.

04.06.2025: The Gini-coefficient measures the overall inequality in countries, that is the gap in terms of income and welfare between the different strate of society. The following article by Alysson Portella illuminates the reasons why this coefficient has been falling since the 1990s, and continues to do so.

09.05.2025: The analysis/study here presented shows that despite the elevated interest rates in Brazil (“Selic rate”), the rentability of property purchases (valuation, rental etc.) is still considerably higher.

- https://veja.abril.com.br/coluna/radar-economico/a-grande-vantagem-do-itaim-bibi-sobre-a-taxa-selic/

06.05.2025: With the Selic rate at one of its highest levels in recent years, set at 14.25% after the last COPOM meeting in March, the cost of traditional financing has increased significantly. Thus the so-called “Consorcios”, alternative financing methods in Brazil based on a group pool of financial resources, is becoming ever more attractive.

11.03.2025: From an overall national perspective the total sales of new properties increased by 11,8 % in 2024, compared to 2023. This is partially due to higher international demand for Brazilian properties caused by the favorable exchange rate, the solid economics and the migration/substitution effect, and partially also to domestic effects.

01.02.2025: Despite high interest rates on financial (fixed interest rate/SELIC) investments the share of real estate investments, also based on financing, on the general investment portfolio in Brazil is increasing.

14.10.2024: Recently a new cycle of interest rate (SELIC) increases in Brazil started, aiming at controlling inflation. The current prevision for 2025 (end of the year) is at 15 %. While high interest rates turn financing options more expensive, on the other hand it helps control inflation and thus increase macroeconomic stability. However, the most important in relation to Brazil is the fact that the Brazilian Central Bank is a highly efficient institution, independent from political mood swings and pressure attempts.

12.08.2024: Rental prices in São Paulo have been increasing for 3 years consecutively, demonstrating the high demand for living space in Brazil´s major metropolitan area.

18.06.2024: Despite the recent decrease in the SELIC rate, the below article criticizes the still elevated level of the interest rates in hindering major real estate investments in Brazil. This is a somewhat controversial view, since on the other hand in Brazil the SELIC controls inflation and thus macro-economic stability.

12.05.2024: This partially surprising survey, described in the exame article here linked, shows that there is a major interest in older, already existing (opposed to planned or new) properties due to favorable parameters like property characteristics or lower prices.

12.05.2024: The below article describes a current trend concerning the investment preferences of cryptocurrencies – that are increasingly being invested in low risk sectors like the property market.

12.04.2024: As the title of the article expresses clearly, the Brazilian housing market continues on a promising and positive trajectory, with a quarter increase (Q1 2024) of 5,54 %.

06.03.2024: In a seminal decision taken on the 6th of march 2024, the minister of the Federal Supreme Court (STF), Flávio Dino, definitively denied an appeal by the Federal Public Ministry against the TRF-2 decision that established rules and conditions for granting the environmental license for the works at the Port of Jaconé, in Maricá. This means that the port will be constructed, strengthening the economic potential of the region considerably.

02.02.2024: The solid economic fundamentals in Brazil, including a decreasing inflation rate, motivate the Brazilian Central Bank to lower the Selic (central bank interest rate) in equidistant steps, the current decrease representing the 5th in a row.

- https://www.wsj.com/articles/brazils-central-bank-expected-to-reduce-pace-of-rate-cuts-52e4f866

- https://tradingeconomics.com/brazil/interest-rate

20.01.2024: The rental prices in São Paulo, quite comparable with other Brazilian cities, have recently increased, with a gap between owner expectations and market potential. Currently there is a trend of closing this gap, with more realistic expectations. The rental market in general continues dynamically.

19.12.2023: Standard and Poor increased Brazil´s rating to BB from formerly BB-, in consequence of renewed growth and a successful tributary reform, a tendency probably to be continued in 2024.

15.12.2023: The recent renewable energy auction strengthens China´s position in the Brazilian energy market and contributing to an improvement of energy transmission on the North-South-Axis of Brazil.

23.10.2023: This article refers to the growth of the multi-property market in Brazil that is progressively attracting the interest of major international hotel brands and companies. Under the here referred business model, each owner has a fraction of the property and can use it for a certain number of weeks or months, depending on the contract. In Europe this is also known as time-sharing.

A similar article, depicting more details, can be found here:

According to material published by the ABRAINC-FIPE (Brazilian Association of Real Estate Developers/Fundação Instituto de Pesquisas Econômicas), the Brazilian real estate market showed growth of 14.4% in property sales in the first seven months of 2023 compared to the same period of the year previous.

23.08.2023: The general demand for rural and agricultural land in Brazil is ever increasing, exemplified by the activities of BrasilAgro, currently developing more than 320.000 ha in Brazil:

July 2023: The following link presents a statistic about price trends on the Brazilian real estate market, showing a decrease in average housing prices in 2023 compared to 2022.

14.07.2023: According to law 14.620 (Medida Provisoria) the “Minha Casa, Minha Vida” program was resumed, a real estate financing program targeting middle income families in Brazil. Created in 2009, the housing program had been extinguished in 2020 and was resumed in early 2023. While the program per se is not interesting for foreign nationals, it is indirectly relevant for investors that intend to purchase larger areas and implement condominios for the Minha Casa Minha Vida program.

29.06.2023: Usina Coruripe, considered one of the major players in the sugar-energy sector in Brazil, reported positive financial and commercial results in the 2022/2023 harvest. According to the balance sheet released this week, the company recorded a record total net revenue of R$3.66 billion, 23% higher than that recorded in the previous harvest (R$2.99 billion).

04.04.2023: The average price of properties in Brazil, measured by a total of 50 cities (all capitals included) rose by 5,66 % in 2022 alone. This expresses, on the one hand, the high demand (and also diminished supply), and on the other hand points at future valuation tendencies.

31.01.2023: The Brazilian real estate market has seen robust figures in 2022 and this year keeps the promise of growth. According to data from Abrainc (association of developers), in the first ten months of 2022 alone, the number of new properties sold in Brazil increased by 11.9%, when compared to the same period of 2021.

In all, 133,891 units were sold from January to October last year, which corresponds to the best performance ever recorded for the sector in the same period since the creation of the historical series, with comparative data from 2014.

05.12.2022 – Summary of Economic Figures Dec. 2022:

- Unemployment is at its lowest since 2015

- Inflation peaked last April and is on its way down

- Agricultural output grew by 58.6%

- The Real gained 6% against the US$ between January and August

- The B3 stock exchange gained 5.8% between January and September

- Property prices rose by 10.5% in Q2

Sources And Articles for Further Reading:

- https://www.dn.pt/internacional/brasil-regista-taxa-de-desemprego-mais-baixa-dos-ultimos-sete-anos-15214776.html

- https://www.reuters.com/world/americas/brazil-posts-deflation-august-fuel-prices-fall-2022-09-09/

- https://data.worldbank.org/indicator/NV.AGR.TOTL.ZS?locations=BR

13.10.2022: Brazil is up-dating and stream-lining the legal part of the real estate sector. A new law enacted in the country promises to modernize and simplify procedures relating to public records of legal acts and transactions, in addition to reducing bureaucracy in the purchase and sale of real estate, with the waiver of several documents. Originally the participants of a sale needed in average 10 different “certificates” from the seller displaying the legal status of the property. This has been reduced to the most basic ones, including the absence of debt and up to date payment of taxes. This should facilitate real estate transactions considerably and increase general demand.

- https://diariodonordeste.verdesmares.com.br/opiniao/colunistas/germano-ribeiro/nova-lei-dispensa-certidoes-e-facilita-a-vida-de-comprador-de-imovel-entenda-1.3288214

- Link to the law text (Secretary General): http://www.planalto.gov.br/ccivil_03/_ato2019-2022/2022/lei/L14382.htm

09.08.2022: Brazil has seen a record inflation in the past, and thus consequently considered by many an inflationary country, despite a strong economy and considerable efforts to curb inflation by restrictive monetary measures and austerity policies enacted by the Central Bank. Thus it is even more remarkable that, for almost decades, Brazil has seen the first month of deflation, with a price decrease of 0,68 %, due to decreasing energy prices and decreases in other areas and sectors. And from a comparative perspective, this is even more impressive taking into consideration the global tendency of inflation. Even in Germany, the homepage owner´s home country, inflation is currently higher than in Brazil. This turns Brazil into an even more attractive investment country.

11. July 2022: A new maritime policy for Brazil – this was the key content of a recent workshop on the 5-7 july 2022, about sustainable development and adjustment to international rules, also with the aim to unify maritime regulations all over Brazil, thus reducing bureaucracy and creating a more transparent environment for real estate owners.

Digression: The high demand for Engineers in Brazil

21.01.2020: While the below article on ingenieur.de was published already in 2020, it is still relevant and noteworthy as of now in 2022, since even the pandemic did not diminish neither the growth potential of the industry nor the need for filling the “engineer gap” specifically. The german article depicts this situation, that there is a huge gap between actual engineers graduating from university and the much higher demand of the industry. Consequently, by means of better working conditions and higher salaries, Brazilian industry is becoming increasingly attractive for foreign highly educated engineers.

- https://www.ingenieur.de/karriere/arbeitsleben/arbeitgeber/arbeiten-in-brasilien/

09.06.2022: Brazil is target of an increasing number of international direct investments, propelling it in 2021 to the 6th position in the global ranking. 2021 50,3 billion USD were invested.

17. May 2022: The below article in focus economics highlights the main challenges Brazil is coming to face in 2022 and 2023. Domestic fundamentals are crucial in the assessment of international impacts. For 2023 an increase in the GDP is predicted.

09. March 2022: The agricultural sector is making headlines in Brazil in terms of performance and current exports (soy, cattle) – despite the pandemic and the scarcity of pre-products and supplies.

04. March 2022: The Brazilian economy has resumed growth at a rapid pace and, as the below article states, left “technical recession”. The effects of the pandemic were remarkably low on the Brazilian economy, and while real estate investors might face a slightly stronger Brazilian currency, they can also expect higher growth and valuation rates and higher future economic stability. High growth rates increase trust in a country´s economy and thus reinforce investor confidence.

- https://brazilian.report/liveblog/2022/03/04/gdp-grows-leaves-technical-recession/

A similar article, published in january, goes even further and states that 2021 has been the best year for the real estate market, due to new credit lines and expanding offers (“lancamentos”).

08. March 2022: The text under the link below explores the perspectives of the real estate market in Brazil in 2022. 2021 has shown a surprising performance and stability, despite the economic and psychological impacts of the pandemic.

01. March 2022: While inflation did increase in Brazil quite as in other parts of the world, it is slowing down and probably will be lower than in the US in 2022. Growth potentials are also responsible for that. Brazil is transforming from a state-driven economy to one where the market plays a central role, and private investment commitments are ever increasing.

12. January 2022: In relation to its energetic matrix Brazil is on the forefront of international advances in this specific sector. According to the EPBR agency, the studies that the Energy Research Company (EPE) should launch in the coming days will raise the possibility of installing blue hydrogen production plants on existing offshore oil and gas platforms in the Santos Basin pre-salt.

26. August 2021: Central Bank Autonomy is a crucial ingredient for economic stability, inflation control and growth. Recently, a new consensus was reached in order to preserve and even strengthen central bank autonomy in Brazil.

06. July 2021: The Covid pandemic in Brazil caused a slight restructuring of the economic sector, leaving industrial production fortified, while reducing the overall share of the service sector in the GDP.

23. June 2021: Brazil is considered currently the most attractive location in Latin America for investments into the Renewable Energies Sector. Being one of the fastest growing sectors in the country, it increased its attractivity ranking by 4 points, as the article below pinpoints. This has also implications for the Real Estate sector, since the demand for rural land suitable for projects increases, thus also leading to investments into infrastructure and regional development.

7. June 2021: The article surmises the projected GDP Growth of 4,36 %, far beyond the original predictions of a mere 1 % growth. This is a testimony to Brazil´s robust and growing economy, even in the face of adversity (pandemic).

June 2021: Contrary to all previous expectations, and also contrary to the largely negative and biased international press, Brazil´s economy is recovering at a faster pace then originally foreseen, despite the pandemic. The agricultural sector´s contribution is certainly noteworthy in that, but also an increasing demand for products and services. Finally, the real estate sector is booming – domestically and also concerning international demand – due to a favorable exchange rate, low interest rates and the migration effect:

June 2021: The Brazil Investment Forum 2021, the major forum of this kind in Latin America, has recently presented projects bound to attract approximately 50 Billion in the coming months. Some details can be studied in the article below:

18. April 2021: The average retail price of agricultural commodities is increasing, due to a stable or increasing demand worldwide. This will impact positively on the Brazilian agricultural sector.

- https://www.farmnews.com.br/gestao/precos-das-commodities-agricolas-13/

8. March 2021: The article highlights some of the key arguments for a renewed growth of the real estate sector in Brazil this year, mainly based on the very favorable Selic-Rate as well as the exchange rate cheapening purchases for foreigners.

22. Dezember 2020: The dynamics in the real estate sector in Brazil and the sales numbers have returned to pre-pandemic numbers. For the real estate market it has been the best year since 2014, with an increase of 20 % in 2020. This runs counter to the decreasing economic data of most of the other sectors of the economy, thus turning the property market into one of the most resilient markets.

15. Dezember 2020: The so-called AGU (Advocacia-Geral da União) regulations, enacted during the Lula Government, represented some of the most serious and long-lasting impediments for investments in Brazil, thus slowing the economic development considerably. The regulations prohibited the acquisition of land above a threshold specific to each state, not surpassing usually 50 ha. Thus, investments were highly shunned due to the legal difficulties and restrictions. Finally, the long awaited and highly expected change took place, with the law project approved by the senate on the 15th of December 2020, facilitating considerably the purchase of land by foreigners. With the only restriction in relation to land in the Amazon region, this new law project opens the acquisition of land in almost all of Brazil. This should heat up considerably the rural and agricultural real estate market in the coming months and years.

3. Dezember 2020: Brazil’s Gross Domestic Product (GDP) grew 7.7% in the third quarter, in comparison with the three immediately preceding months, confirming the country’s exit from the so-called “technical recession”, according to data released this Thursday by the Brazilian Institute of Geography and Statistics (IBGE).

- https://g1.globo.com/economia/noticia/2020/12/03/apos-tombo-pib-do-brasil-cresce-77percent-no-3o-trimestre.ghtml

- https://revistaoeste.com/pib-do-brasil-cresce-e-tem-maior-variacao-desde-1996/

27. October 2020: The world´s largest investment Bank, Morgan Stanley, is highly advocating investments into Emergent Economies, foremost Brazil. This stands in line with the recommendation of several international organizations and investment banks that see high future growth rates and a soon-to-strengthen Brazilian currency. Also, the exemplary management of the Corona Crisis is one of the variables entering the “equation”:

In a similar mannhttps://veja.abril.com.br/blog/radar-economico/agora-e-o-morgan-stanley-que-diz-para-os-estrangeiros-comprarem-reais/er, the Bank of America also recommends investing in Real:

21. October 2020: Sales of Luxury Real Estate in Brazil are currently skyrocketing. The article below, published by bloomberg, shows the dynamics in a specific region of São Paulo. The Covid Crisis is contributing to this dynamics, with increased number of home offices and the so-called migration effect, that is buyers and investors looking for time-invariant “secure” assets like real estate. Another factor contributing strongly is the favorable exchange rate which makes purchases in Brazil considerably cheaper for foreigners. While it is strong that prices of some properties (not in all cases, though) are increasing, this is more than being offset by the exchange rate (value loss) of the Brazilian Real.

31. August 2020: In July 2020 the real estate market in São Paulo had a growth of 21 % in july compared with the previous year. This is indicative of a general tendency of “real estate growth” in Brazil, including the so-called migration effect – that specifically in times of global crisis investors prefer to invest in time-invariable, stable assets.

23. July 2020: It certainly came as a big surprise when the New York Times, an ardent critic of Brazil´s government and economy, published this article, praising Brazil´s performance during the Covid-Crisis, in terms of economic recovery and also of the management of the health crisis per se. This should increase investor confidence considerably, especially surpassing all expectations.

22. June 2020: Considering the current worldwide crisis, it might appear surprising that Brazil returned to the list of the 25 most reliable countries for foreign direct investment (FDI), according to an indicator produced by the North American consultancy A.T. Kearney, released on the 16th of june 2020. After being left out of the list last year, the country is the only nation in Latin America to compose the list in the 2020 ranking. For the eighth consecutive year, the United States leads as the most attractive country for foreign investments, followed by Canada, Germany , Japan and France. Complete the list of the top ten, in order: United Kingdom (6th), Australia (7th), China (8th), Italy (9th) and Switzerland (10th).

The Kearney Foreign Direct Investment Confidence Index (FDI) is an annual survey of executives from the 500 largest companies in the world since 1998. Ratings are calculated based on questions about the likelihood that respondents’ companies will make a direct investment in a market in the next three years. The score varies on a scale of 1 to 3. In the case of Brazil, the score was 1.65.

- https://agenciabrasil.ebc.com.br/economia/noticia/2020-06/Brasil-volta-a-ficar-entre-os-mais-bem-avaliados-em-ranking-global

- https://www.canalrural.com.br/economia/brasil-volta-para-lista-dos-25-paises-mais-confiaveis-para-investimento/

6. March 2020: The below article is an interview with Trabuco Cappi, president of the Administrative Council of the Bradesco Bank. While stressing the importance of a continuous reform process in Brazil, he also states that the confidence in Brazil´s economic future increased considerably, turning it despite different global crisis scenarios into a potentially safe haven for international capital.

26. January 2020: “Gargalo” is a Brazilian portuguese word which means bottleneck. The lecture performed by Lauro Andrade Filho in Balneario Camboriú, on the 30th of january 2020, exemplified that despite existing bottlenecks there has been a steady growth during the last two decades.

24. January 2020: In economic science quite often so-called “proxy variables” are used in order to describe, indirectly, the performance of another variable. If we take the real estate and construction sector for example, one of its “proxies” is the performance on the labour and employment market. The higher the general employment rate, the higher the available income and thus the purchasing power of the populace. As has been proven in several studies, this influences directly the dynamics on the real estate market. As the below article of exame states, in 2019 more than 644.000 new formal jobs were created in Brazil, the highest number since 2013. What is especially remarkable is that large share of the construction sector, with 53.000 new jobs. This testifies to a rapid recovery of the real estate market.

11. January 2020: JP Morgan sees Brazil currently as “overweight” – which means “above market average performance”, with an increase in economic growth, and considers Brazil as one of the best investment countries in Latin America in 2020, only equalled by Colombia.

10. January 2020: According to estimates by the Worldbank and the International Monetary Fund, Brazil consolidades its position as 9th strongest economy in the world, with increasing growth rates. As the extract from the mercado e consumo below states, a growth rate of more than 2 % until 2024 is projected, surpassing the United Kingdom.

18. Dezember 2019: The Brazilian minister of economy, the liberalist Paulo Guedes, said on Wednesday that Brazil will face an “avalanche of investments” in 2020, which will come from both the domestic and foreign markets. According to Guedes, resources will mainly flood the area of infrastructure, especially sanitation, whose legal framework is being updated in Congress. According to the minister, this will allow the Brazilian economy to grow by at least 2% in 2020, according to a conservative Guedes himself.

16. Dezember 2019: The domestic flight sector in Brazil certainly never has been one of the most competitive markets, due to a rather low number of flight companies – a situation slightly aggravated by the recent retreat of Avianca from the domestic market. However, the Brazilian government is responding to this challenge with a further opening of the market, attempting to attract 40 aerial companies to operate in Brazil. This can be considered as renewed investment into the infrastructural development of the country.

12. Dezember 2019: The Comitê de Política Monétaria (COPOM), the central monetary institution of the Brazilian Central Bank, seems determined to continously empower economic growth in Brazil. This is one of the reasons for the recent decision to lower the SELIC rate to 4,5 %, another consecutive record low of interests in Brazil. This should spur economic dynamics and reinvigorate the real estate market with access to cheaper credits.

11. Dezember 2019: Brazil´s credit rating is bound to improve. Standard and Poor´s increases the rating perspective of Brazil, hinting at the improving fiscal situation. S&P reported that Brazil is adopting reforms to reduce the public account deficit. In addition, falling basic interest rates (SELIC rate), which are at their lowest levels in history, help to control the government debt. Rating increases will depend on the successful pursuit of the reform agenda.

15. November 2019: Brazil and China are intensifying their economic and political relations. As reported by Folha de São Paulo, China is putting at disposition 100 billion USD for infrastructure projects in Brazil. A cooperation accord was signed with the Chinese Minister of infrastructure for the joint development of future infrastructure projects. Several advantages of this strategy are projected, among them a better access to cheaper credits by Brazilian companies, as well as the reduction of transaction costs with regard to the Chinese currency.

30. October 2019: After the successful conclusion of the pension reform, a possible membership of Brazil in OPEC might be the next seminal milestone on the road to economic recovery. Saudi Arabia invited Brazil to become a member, which was positively received by President Jair Bolsonaro. According to the Bloomberg article, in September 2019 Brazil was the third biggest oil producer worldwide.

23. October 2019: The long coveted and highly impactful Pension Reform was finally approved – a economic-political milestone event that even the critical international press holds in high regard. It went through its last legal step, the approval by the senate – which for quite some time was quite in the balance and far from secure. Among others, it raises the retirement age for men to 65 and women to 62, following a pattern of pension reforms in the western world which have started decades earlier in other places. In terms of increasing investor confidence and overall economic performance this can be considered as seminal milestone, and hopefully with many more to come (for example tax reform).

October 2019: Recently the very comprehensive Investment Guide Brazil 2019 was published. It highlights on more than 180 pages different advantages and key sectors of the Brazilian economy. To quote from the introductory page, “Brazil has an open and diversified economy and

a wide array of opportunities across multiple productive sectors. Although Brazil is home to a competitive industrial sector, leading a number

of industries in Latin America, there are still numerous opportunities for business development in areas such as energy, oil and gas, health care,

agribusiness, infrastructure and innovation, among many others.” It is based on information from government sources and was created by Apex Brazil (Agência Brasileira de Promoção de Exportações e Investimento – the Brazilian Agency for the Promotion of Exports and Investments). Its purpose is to identify investment opportunities and help guide investors by providing information about the fundamental variables of the economy.

- Link to the Investment Guide here: Investment_Guide_to_Brazil_2019

8. October 2019: The liberalization of a national economy, with all that it entails, is paramount to economic growth. Another important step was announced by president Jair Bolsonaro, which is yet to be presented to Congress. It refers to the liberalization of the exchange market, providing greater liberties for Brazilian exporters to manage their financial ressources abroad. As the article states, “Bolsonaro’s bill also allows local banks to grant loans to non-residents economic agents, which means that Brazilian banks will be able to finance foreign importers of Brazilian products.” These tendencies should strengthen the economy significantly.

8. October 2019: Recent data published by the IBGE, the Brazilian Institute for Geography and Statistics, suggest that the Brazilian Economy is growing faster than expected after some negative reviews at the beginning of the year. Only in august the industry in São Paulo state grew by 2,6 % (entire Brazil: 0,8 %) and is thus getting close to the all-time peak measure in 2011. While admittedly São Paulo has the strongest regional economy in the country, it is indicative of an overall growth and might hint at a faster recovery than expected.

Also, an article published by the Financial Times on the 29th of august 2019 stated an early recovery (https://www.ft.com/content/4ec6483c-c358-11e9-a8e9-296ca66511c9 a tendency that has yet strengthened.

2. October 2019: The Tourism sector in Brazil is growing again, due to favorable economic conditions, but also heavy investments in infrastructure. It showed record growth in the first months of this year, with a total income of R$ 136.7 billion, which represents the largest recorded in the last four years. In addition, the industry has created more than 25,000 jobs in the last 12 months (ending July). The data appeared in the unprecedented survey of the National Confederation of Trade in Goods, Services and Tourism (CNC), released this week.

25. September 2019: Employment and its opposite, unemployment, be it seasonal or structural, is one of the key figures of the economic situation of a country. A high employment increases overall welfare, and in more technical terms a higher purchasing capability of the populace, which also influences the dynamics on the reale state market. Brazil has suffered from elevated unemployment rates during the last years, but finally figures are improving. In August 2019 roughly 121.000 new formal jobs have been created, reverse the tendencies of the past years.

15. – 17th September 2019: The capital of Rio Grande do Norte, Natal, hosts another edition of the Brazil-Germany Economic Meeting (EEEBA), an important event focused on relations between the two countries. With the principal topic being Brazil-Germany Partnership in times of global change, the event will bring together government officials and business leaders from both countries to discuss expanding investments and new forms of cooperation. While focussed on the bilateral relations between Brazil and Germany, the there developed approaches and models maybe be valid also for different international partnerships and possibly serve as blueprints.

29. August 2019: Brazil, a traditionally relatively closed and protectionist country, is increasingly opening up. A milestone on this way is the recent liberation of the visa requirement for citizens of Australia, Canada, the United States and Japan. This has led to a significant increase of tourism in Brazil, which reflects in the increased revenues from tourism. The article published in the official tourism site mentions an increase of 43,4 % in revenues in July 2019, compared to the same month in 2018.

The Brazilian Economy is resuming growth. The Gross Domestic Product (GDP) increased by 0,4 % in the second trimester of 2019, thus escaping recession. In comparison to the same period in 2018, the GDP grew by 1 %. This growth, among other, consists of a strengthening construction industry (2,9 % increase), while the share of the extraction industry (mining etc.) has declined (- 3,8 %).

The construction sector was one of these that suffered most from the economic crisis of the previous years, with 20 months of consecutive decline. Finally, the sector is recovering, based on data from the IBGE (Instituto Brasileiro de Geografia e Estatística), with a growth in the second trimester of 2019 of 2 %, and an increase of investments of 5,2 % in comparison to the second trimester of 2018. This traditionally strong sector contributes significantly to the GDP and is also a good indicator for employment growth. The currently observed improvement of the construction sector is partially due to the favorable credit environment, with expansion of available financing options and record-low interest rates in Brazil.

21. August 2019: Debureaucratization is on its way in Brazil. The recently approved (21. of August, Senate) “Lei de Liberdade Economica” (Law of Economic Freedom) is actually a so-called “Medida Provisoria” (Provisionary Measure) which as been turned permanent by Congress Voting. It enacts a variety of economic and legal measures facilitating immensely economic endeavours, like diminished restrictions and registration obligations and in general facilitated procedures when it comes to opening and administering a company.

- https://www12.senado.leg.br/noticias/materias/2019/08/21/aprovada-mp-da-liberdade-economica-sem-regras-de-trabalho-aos-domingos

20. August 2019: The following promotional video was recently published by the Brazilian Ministry of Infrastructure. While each promotional publication, due to its inherent nature tends to overemphasize the benefits and advantages of a given issue, the main tenets presented in this video correspond to the empirical facts. Brazil is increasing investments in infra-structure (railways, ports and interstate-highways), turning the country every more attractive to international investors. The video can be watched in english language.

14. July 2019: Recently, the Estadão published an information page regarding ongoing privatizations and concessions on PPP (Public-Private-Partnership Programs), regarding Airports, Energy Sector, Mining, Oil and Gas, Railways, Road-Construction and Ports. The below info-graphics can be found under the below link, which shows privatizations and denationalizations that have already happened or are yet to occur. It shows also the type of operation as well as the market value. Privatization, if well regulated and planned, is an important step towards a liberalization of the economy and thus economic growth. It is part of the political agenda of the market-oriented minister Paulo Guedes.

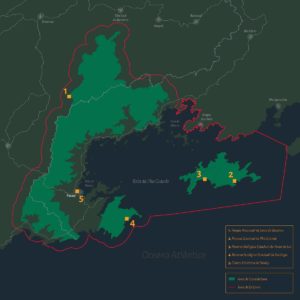

2. Regional News – Regional Developments

Here we will publish state and region-specific news, in alphabetic order.

Structure:

Alagoas

Bahia

Ceará

Paraná

Rio de Janeiro

Rio Grande do Norte

Rio Grande do Sul

Santa Catarina

São Paulo

Sergipe

Alagoas

The state of Alagoas is the second smallest Brazilian state in area, only surpassing Sergipe, and it is 16th in population. It is also one of the largest producers of sugarcane, coconuts, and natural gas in the country. Alagoas also has oil exploration, mostly of onshore deposits. It has many natural wonders and the skyrocketing real estate market explores this potential. The development potential is considerable, as promoted by the state government:

03. October 2025: Demand for compact properties, high profitability, and tourism are fueling a real estate boom in Maceió, which is exposing gaps in urban planning.

2024: This phd thesis investigates real estate transaction dynamics in Maceió, Alagoas between 2020 and 2023, focusing on the Sales Velocity Index (SVI).

16. October 2024: Conhecida pelas praias de águas cristalinas, Maceió (AL) tem o metro quadrado mais caro entre as capitais do Nordeste – mesmo sendo apenas a quinta maior economia da região. The city represents an excellent investment opportunity in the Brazilian Northeast.

23. January 2024: Alagoas saw a 15% increase in the prices of houses, apartments and commercial properties. From January to November of last year, the price of real estate in Maceió increased by 15.44%. Among the capitals, the second highest increase was observed in Goiânia, with a positive variation of 13.11%.

25. January 2020: The small Brazilian state of Alagoas is another example of a strongly evolving region in the Brazilian North-East. As Published by the Secretary of Tourism of the state, the advance of local tourism has already been reflected in the growth of the hotel offer in the capital of Alagoas, Maceio. These are new developments that contribute to the expansion of the tourism sector which has grown 30.38% in the last two years, compared to the 2016/2017 biennium.

Bahia

The property market in Bahia is supported by an elevated local demand, in particular from Salvador, however, there are three different sets of investors – people from Bahia, domestic national buyers from all over Brazil as well as foreign buyers.

With local buyers remaining the dominant force in the market – and still having a diverse set of investors – the demand for properties in Bahia is supported by solid fundamentals. As investment in real estate is expected to continue, the real estate market is expected to grow and develop in line with the Brazilian economy in general.

More specifically, the real estate market in Salvador has become ever more dynamic, with attractive prices and high quality constructions.

About the economic growth potential of Bahia: https://www.ba.gov.br/noticias/350493/secretaria-de-desenvolvimento-economico-destaca-potencial-da-bahia-dentro-e-fora-do-pais

30.12.2025: The Maraú Peninsula, on the southern coast of Bahia, has been gaining national prominence not only for its crystal-clear beaches and stunning landscapes, but also for establishing itself as one of the safest tourist destinations in Brazil. It is one of the foremost investment targets in Bahia.

12. February 2025: The appreciation perspective for Itaparica island is at 20 % after the construction of the bridge, turning it into one of the destinations in Bahia with the highest potential valuation potential.

8. October 2024: Financing is progressively being provided for for the future bridge connecting Itaparica and the Bahia mainland.

30. September: In a comparative perspective (reference the year 2023) the property market is growing, with a rate of 24,25 % – almost one quarter more.

14. June 2024: The municipality of Maraú, one of the most beautiful regions in Bahia, will be part of the official touristic roadmap of Brazil (Classification of the Touristic Zone of the Cacau-Coast). Maraú’s good rating is a consequence of the excellent hotel network available, the growing number of tourists on the peninsula and the participation of tourism in the economy.

14. March 2024: The Financing of the Salvador-Itaparica Bridge stands, as one of the major partners being the Banco do Brasil.

19. May 2023: Not even one month after the publication of the last statement of ADEMI-BA (Association of Real Estate Companies in Bahia), see the link below from 29. march 2023, numbers have improved beyond expected, with an increase of 6,4 % in terms of property sales compared to the same month in the previous year.

29. March 2023: The construction on the Salvador-Itaparica bridge is bound to start:

24. March 2023: In 2023 the real estate market in Bahia is projected with a growth of 5 %, as predicted by the ADEMI-BA (Association of Real Estate Companies in Bahia). The authors do admit that 2022 and the beginning of 2023 was rather difficult, with drops in market activity (by 16,3 %), partially due to crisis factors as well as the elevated exchange rate. However, this scenario is bound to change with more positive outlooks in 2023:

5. May 2021: The new bridge connecting Salvador and the Ilha da Itaparica is bound to start its construction process by the end of this year.

12. November 2020: Two chinese companies will be responsible for the construction of the Salvador-Itaparica bridge, one of the foremost infrastructural projects in Bahia. It is bound to increase the capital value of the region considerably.

27. August 2020: With construction works scheduled to start in the first quarter of 2021, the North Coast of Bahia will receive a sustainable tourist and housing development. Called Aguaduna City, the project will be conceived in the model of smart city.

- http://atarde.uol.com.br/bahia/noticias/2137248-empreendimento-de-cidade-inteligente-no-litoral-norte-da-bahia-deve-ser-iniciado-em-2021

- https://www.correio24horas.com.br/noticia/nid/projeto-de-cidade-inteligente-no-litoral-norte-tera-investimento-de-r-16-bilhao/

23. January 2020: The new convention center in Salvador was inaugurated, in the footsteps of the former Aeroclube. It is destined to value the region considerably and increase the infrastructural value of the beach regions in Salvador.

13. Dezember 2019: A consortium formed by three Chinese companies was the winner of the auction for the construction of the Salvador-Ilha de Itaparica bridge, held on Friday (13), at the São Paulo Stock Exchange. The consortium’s investment will be $ 6 billion, while the Government of Bahia will provide $ 1.5 billion. The bridge´s management and administration will last for 30 years. It represents a major improvement in the regional infrastructure, with significantly shortened travel times between the mainland and the island.

4. June 2019: Bahia maintains one of the highest investment ratios in infrastructure in Brazil. This reflects, on the one hand, a general increase in infrastructure investments in all of Brazil, on the other hand a very accentuated investment dynamic in Bahia state. According to information of the state government, between january and abril 2019 approximately 555 Million R$.

14. March 2019: The first estimates related to Bahia’s economic performance point to growth that should again follow the trend of Brazilian GDP, however, with a slightly lower projection than that made by Focus Bulletin of the Central Bank.

- http://www.corecon-ba.org.br/cenarios-para-a-economia-baiana-em-2019/21447/

2. March 2019: The growth perspectives for the real estate market in Bahia are optimistic. Besides being one of the Brazilian states with the highest growth rates in the tourism sector (Praia do Forte, Sauípe etc.), a research recently conducted by the CNI (Confederação Nacional da Indústria), together with the ADEMI-BA (Associação de Dirigentes de Empresas do Mercado Imobiliário da Bahia) pinpoints a growth of 7 % in 2019. It further highlights that this growth will be observed on the litoral area as well as in the interior of the state.

25. February 2019: The projected bridge, 12,4 km long, that ought to connect Salvador and Itaparica, should increase the economic and touristic attractivness of the region significantly. The original idea of the bridge goes back to 1960, however was not realized until this day. While showing Brazil´s commitment to infrastructure development in general, it also is a testament to China´s increased economic interest in Brazil. Be as it may, the real estate market in the nearby region will profit from these developments without doubt.

- https://www.infrapppworld.com/news/brazilian-state-prepares-ppp-for-us14-billion-bridge-project

- https://www.valor.com.br/international/news/6122631/chinese-firms-eyeing-r53bn-salvador-itaparica-bridge

Ceará

Ceara houses 55% of Brazil’s scrublands and is known as the “Land of Light” given the great number of sunny days, and more so because it was the first state of the federation to abolish slavery in 1884, four years before the Golden Law.

Ceará is one of the most coveted states in terms of real estate investments in Brazil. Traditionally one of the less developed states in the country, certain regions have developed almost beyond recognition over the last 20 years, mostly from tourism and light manufacturing. The population is closing in on 9 million, of which almost a third lives in the capital Fortaleza. Numerous investments in infrastructure turned this state into a tourism hotspot.

- Statistical and Demographic Information about Ceará: https://www.ibge.gov.br/cidades-e-estados/ce.html

17. June 2025: Ceará is experiencing a strategic transformation in the real estate sector. Amid new developments, the appreciation of horizontal housing and a coastline increasingly connected to international sports tourism, names like Eduardo Pereira are helping to shape this new scenario. The author, Eduardo Pereira, is affiliated with Real Estate Brazil.

19. June 2024: The number of renewable energy projects in Ceará is steadily increasing, also relying on Chinese investments.

25. October 2023: The article refers to a pre-contract for the production of hydrogen and green ammonia in the Pecém Industrial and Port Complex The investment is in the order of US$2 billion, strengthening the energy matrix of the region

03. October 2023: The Tourism sector in Ceará is growing steadily and generating new jobs:

10. February 2022: As the below article states, the state government of Ceará inaugurates second expansion of Porto do Pecém, which will be a major logistics hub in the region, increasing the commercial value of the state:

2. February 2022: Americold Logistics, LLC, one of the largest packing house operators (a facility where agricultural products are received to be processed before going to market) and refrigerated cargo in the world, expressed an interest in investing in distribution centers in Ceará. If the deal is confirmed, the port of Pecém could become a national hub for refrigerated cargo.

- https://www.opovo.com.br/noticias/economia/2022/02/02/governo-negocia-atracao-de-cd-da-americold-logistics-para-o-ceara.html

17. December 2020: The article below highlights new fiscal incentives being introduced by the state of Ceará, strengthening the local economy by facilitating the granting of fiscal incentives (for example tax exemptions) to companies.

- https://www.adece.ce.gov.br/2020/12/17/mudancas-na-politica-de-desenvolvimento-economico-cearense-sao-aprovadas-na-assembleia-legislativa/

10. April 2019: A decisive pillar of Fortaleza´s infrastructure developments is represented by the modernization and amplification of the International Airport Pinto Martins. The article below highlights some of the most important key aspects, among them a projection of receiving up to 20 million passengers per year. The airport was recently taken over by the German airport administration company Fraport (Frankfurt/Main). Fraport also as an administration contract for the airport in Porto Alegre, demonstrating the companies commitment with Brazil´s infrastructural future. The investments into the airport in Fortaleza will strengthen Ceara´s significance as tourism hotspot in Brazil.

- https://www.ceara.gov.br/2019/04/10/com-60-da-obra-concluida-aeroporto-de-fortaleza-se-prepara-para-receber-ate-20-milhoes-de-passageiros-por-ano/

- Here are some views of the interior:

.

.

Paraíba

01. December 2023: The recent article states that a Chinese Group announced the construction of a completely new port city in Paraíba, with an estimated investment volume of 150 Billion R$ and the potential of creating 100.000 jobs.

28. June 2023: The article states and elaborates that João Pessoa is the northeastern capital that grew the most in the last decade, according to the Brazilian Institute of Geography and Statistics (IBGE). Between 2010 and 2022, the city welcomed more than 110,000 new residents. Paraíba also grew, with 207 thousand new residents, with the capital being responsible for more than half of the increase in this population.

Paraná

Introductory Article and Video about Paraná and its touristic potential:

General Economic Facts about Paraná:

27.02.2024: In comparison to the previous year, sales increased by 8,8 % mainly in Paraná, Rio Grande do Sul and Santa Catarina. The figures mentioned in the article are based on a publication of the Brazilian Chamber of Industry and Construction (Câmara Brasileira da Indústria da Construção (Cbic))

01. February 2022: The article states that the real estate market should continue to heat up in Curitiba throughout 2022. It is the result of two independent studies one carried out by the Instituto de Pesquisa e Desenvolvimento do Mercado Imobiliário e Condominial (Institute of Development Research of the Real Estate Market – Inpespar), belonging to the Secovi-PR system, and another carried out by the Association of Directors of Companies in the Real Estate Market of Paraná (Ademi-PR) in partnership with Brain Intelligence Strategic, a business research and consulting company.

Rio de Janeiro

“Recte Rem Publicam Gerere” (Latin) “Conduct the affairs of the public with righteousness”

This official motto of Rio de Janeiro state might not be the first thing that comes to mind when thinking about this iconic city and state, world famous for its natural beauties, its beaches and lifestyle. Yet it also expresses, like Brazil´s flag motto (“ordem e progresso” – Order and Progress) a basic tenet of Brazilian public administration, despite the occasional corruption and accounts on inefficiency. Statistically, Rio de Janeiro´s (as well as Brazil´s) “ethics of conduct” are improving and express the desire to become a world-leading nation, not only known for beauty and stereotype, but also for development and progress.

Statistical Information about Rio de Janeiro – Census Overview: https://censo2022.ibge.gov.br/panorama/

30.05.2025: Luxury real estate sales grow nearly 300% in Rio. From January to March, 219 units were sold in the state capital.

06.07.2024: The region around Teresópolis is exceptionally beautiful. It has been founded 133 years ago, its name derived from Teresa Cristina, the wife of late emperor Dom Pedro II. The below article shows aspects of the beauty of the surrounding regions.

It is furthermore known as the city of the water sources (“cidade das fontes”) with 12 separate mineral water origin points: https://www.portalmultiplix.com/noticias/turismo/voce-sabia-teresopolis-e-a-cidade-das-fontes

09.07.2023: According to a larger Real estate company in Rio de Janeiro the demand for luxury properties in the second major city in Brazil has increased by a skyrocketing 35 % compared to previous years. The favorable exchange rate is identified as one major variable, while other possible causes are unaccounted for, possibly related to a post-pandmic scenario. In any case this is promising for the real estate market.

04.03.2023: According to the Quinto Andar Purchase and Sale Report, the current average price per square meter in the city is R$5,102. Compared to 2021, this total represents an increase of 10.84%. However, in comparison with the last quarter of 2022, it is possible to observe a decrease of -5.46%.

17.07.2022: The real estate market, even in the luxury sector, as exemplified by the investment dynamics in Rio de Janeiro, continues solid:

28. October 2021: Maricá, located on the Guanabara bay opposite to Rio de Janeiro, is less known than the splendid metropolis, however it has turned in recent years in a booming residential and touristic center. It is a stunning place reuniting culture and nature and has become a target for real estate investments.

- https://odia.ig.com.br/marica/2021/10/6262286-conheca-mais-marica.html

30. September 2020: The region around Cabo Frio, Búzios and Arraial do Cabo represents one of the major touristic hubs in Brazil New investments are planned in order to spur tourism, highlighting the role of the airport in Cabo Frio with new investments and improvements in the infrastructural developments of the region.

19. February 2020: One of the major variables influencing real estate investments is the overall security situation in a region. Rio de Janeiro has unfortunately a history of violence and homicide – a tendency, which however seems to revert itself gradually. Security has increased and also the number of homicides decreases, which should strengthen investor confidence and improve the overall attractiveness of Rio de Janeiro.

17. February 2020: The infrastructural future of Angra dos Reis is currently being discussed and planned at large. A meeting defined investments to stimulate growth of the tourism sector in Angra dos Reis. Among the topics discussed were the expansion of the airport and the Marina São Bento project. Officials such as the state senator, Flávio Bolsonaro and the minister of Tourism, Marcelo Álvaro Antônio, were present.

21. October 2019: The Brazilian Ministry for Tourism has announced an additional 15 Mio. R$ of investments to improve the infrastructure in the region and preserve the cultural heritage of Angra dos Reis. The resources will be used to adapt and merge the Fisherman’s Wharf and Santa Luzia Wharf, the illumination of historical monuments and the construction of the Costeirinha Pier, the convention center, Gordas beach lookout point, the Vila cultural pole and several other historical and touristic places.

31. July 2019: The current government is planning heavy investments in the region in and around Ilha Grande, aiming at doubling tourism in the next years. The tourism potential is, estimated by Angra e Ilha Grande Convention & Visitors Bureau, bigger than Mexiko´s Cancun. Several international investors have declared their interest in investing in this region. However, there might be some kind of environmental impact – which should be reflected in a sustainable and ecological development.

Update 13. August 2019: The potential investments into the touristic development of the region will amount to approximately 1 Billion R$, targetting around 40 distinct items, like improvement of infrastructure, the construction of touristic complexes or a new desalinization plant.

05. July 2019: Paraty was officially recognized as world cultural and natural heritage by UNESCO. With it, Brazil has now 22 places the fall into this category. The classification of Paraty as world cultural and natural heritage was based on two aspects: first, culturally in relation to its historic center, and second, in relation to its exuberant surroundings nature, encompassing a 149.000 ha large area, including famous national parks and reserves like the National Park of Serra da Bocaina, as well as 187 islands.

14. May 2019: Paraty e Ilha Grande, em Angra, podem se tornar patrimônio mundial:

- https://g1.globo.com/rj/sul-do-rio-costa-verde/noticia/2019/05/14/paraty-e-ilha-grande-em-angra-podem-se-tornar-patrimonio-mundial-da-humanidade.ghtml – This article highlights the prospects of Angra dos Reis, specifically Ilha Grande, to become UNESCO world cultural heritage.

20. October 2017: Macaé is one of the fastest growing cities in the state of Rio de Janeiro, with record investments in infrastructure and commerce. One of the foremost port locations, it is a nexus for offshore oil platforms. The below article corroborates the enormous growth potential of Macaé, which will receive 25 new platform contracts in the coming years. This should, among many other investments into the (also touristic) infrastructure lead to a enormous valuation of the region.

Rio Grande do Norte

17. March 2025: The gross sales of properties in Rio Grande do Norte are sky-rocketing, in 2024 almost 40 % superior to 2025. The article highlights demographic as well as economic factors as main drivers of this development.

18. Juni 2019: São Miguel do Gostoso, part of São Miguel de Touros, is one of the most attractive touristic regions in Rio Grande do Norte. The below article highlights some of the advantages and benefits of this place and shows some touristic attractions, like the Calcanhar Lighthouse, as well as the numerous leisure activities in the region.

Rio Grande do Sul

In terms of quality of living and infrastructure Rio Grande do Sul has one of the highest standards in Brazil. One highlight for everyone visiting the state is the historical center of Porto Alegre. The following video shows some of the planned projects for the city:

16. September 2025: The rapidly developing state of Rio Grande do Sul occupies five of the top 10 positions in the ranking of cities building the most affordable housing in the South region of the country, according to data from Brain Inteligência Estratégica for the first half of the year. Canoas leads the Rio Grande do Sul region with 1,274 apartment launches, taking second place in the ranking, followed by Porto Alegre, with 1,131 units, in third place. It is a testament of the dynamic development in the real estate sector.

09. October 2024: In Lajeado, one of the most rapidly developing urban centers in Rio Grande do Sul, the highest building of the state was recently erected. It is a testament to the construction dynamics in the state.

24. August 2024: The article states that the property market in Rio Grande do Sul is recuperating and demand increasing.

03. June 2024: The flooding that had struck Rio Grande do Sul is leading to an increase in rentals – shortterm as well as longterm – some of them not being able to return to their former homes.

Rondonia

Rondonia is a state of the Northern Region of Brazil, and the third richest state in this region, responsible for 11 % of the gross regional product. It is increasingly being developed (new infrastructure projects) and integrated into the South American trade.

General News about Rondonia: https://www.emrondonia.com/

23.06.2023: The Brazilian state of Rondônia is preparing for infrastructure improvements that will positively impact the local real estate market. The announcement of an increase in the state’s highway budget has sparked high expectations in the real estate sector, which is already projecting growing demand for housing and commercial developments in the region.

23. December 2021: The following article refers mainly to public development projects of Rondonia´s capital, Porto Velho. While during the pandemic several projects were put on halt, they are resumed now.

Santa Catarina

Located in the South of the country, between Rio Grande do Sul and Paraná, the State of Santa Catarina is composed of 295 cities. All of these municipalities contribute to this state being quite a plural region and focused on a very differentiated economy. The diversity of climates, landscapes and reliefs stimulates the development of different activities and attracts investments from different segments. This allows the state’s wealth not to be concentrated in just one place. Extractive activities, agriculture, fishing, industry, clothing, civil construction, technological centers and, of course, tourism are part of the Santa Catarina economy.

Tourism alone accounts for 12.5% of the State’s Gross Domestic Product (GDP), according to the SC State Government. The approximately 7.1 million inhabitants, according to IBGE’s 2019 estimate, have the differential of living in a state in which quality of life is excellence. Life expectancy and quality are the main differentials of Santa Catarina. This is what makes the State 2nd in the ranking of the best states to live in Brazil, according to the General State Management Challenge Index of 2018.This index takes into account areas such as health, education, security, living conditions and others. According to this index, Santa Catarina stands out especially for life expectancy. In the state, residents live an average of 79.4 years

Further Reading about Santa Catarina´s economic potential:

https://diregional.com.br/di-chapeco/economia/72-das-exportacoes-catarinenses-foram-do-agronegocio

https://www.simmmef.com.br/index.php/o-setor

https://www.carvaomineral.com.br/conteudo/ingles/coop_alemanha.pdf

http://www.atlasbrasil.org.br/ranking

https://www.sc.gov.br/noticias/temas/seguranca-publica

Another relevant question for investors in Brazil is the possibility to obtain fiscal incentives. Santa Catarina has several kind of economic incentives. This includes tax incentives and exemptions. The following link shows some examples of the TTD – TRATAMENTO TRIBUTÁRIO DIFERENCIADO, the differentiated tax treatment:

The Institute for Urban Planning of Florianopolis, IPUF, is an excellent reference providing information about construction possibilities and the development of the region: https://ipuf.pmf.sc.gov.br/

The following article highlights, in general, the advantages of investing in Santa Catarina (May 2022).

28.01.2026: The article highlightes the fact that, with a territory of just 490 km², on the northern coast of Santa Catarina, the region around Balneário Camboriú consolidated itself in 2025 as the fifth largest real estate market in Brazil in terms of financial volume.

29.09.2025: Balneário Camboriú is leading Brazil´s real estate development forefront with ever more spectacular constructions, like the Senna Tower, bound to be one of the highest residential buildings worldwide. The article focusses on some of the construction characteristics. The ultra-high-strength concrete developed specifically for the project, applied with international companies, will meet extreme structural load, durability, and thermal performance requirements—conditions that…

17.03.2025: Latin America´s tallest skyscraper, the Senna Tower, is currently being constructed in Balneário Camboriú, increasing the attractiveness of Balneário, underlining its main feature as modern city, a Brazilian “Dubai”.

09.10.2024: The district of Jurerê Internacional recently underwent a significant transformation with the beach widening project. This development has not only changed the landscape of the region, but is also redefining its economic, social and environmental future and potential.

03.06.2024: From Florianopolis airport soon direct flights to Lissabon will be initiated, increasing the attractiveness of Santa Catarina to visitors, tourists and investors.

21. March 2023: A new park in Florianópolis has been made official. As part of the celebration of the city’s anniversary, the Habitasul group will launch the “Fundamental Tree” of the future Jurerê park, on the beach known as Jurerê Internacional. According to the investors, there are 155000 m² of vegetation area, with 30000 m² of leisure areas. The follow publication provides some details:

30. March 2023: The following article states that In the 2022 ranking, the city of São Paulo (including the metropolitan region) is the one with the best quality of life in Brazil, with an Human Development index of almost 0.842. In second place comes Florianópolis, in Santa Catarina, with an index of 0.833, followed by Curitiba, capital of Paraná, with an HDI of 0.810.

March 2023: A recent New York Times publication describing the advantages of living in Florianopolis.

17. January 2022: General Tendencies in Brazil show a surprising diminishing of violence in Brazil, with the southern states spearheading this development. The below article depicts this development, bringing Santa Catarina as notable example with a 14 year record low in violence and a corresponding increase in public security.

18. October 2020: Santa Catarina is not only a state ideally suited for real estate investments, characterized by high standards of living and stunning natural environments, but it is also a state offering an intense cultural life, due to its immigration history very close to the European past. It also developed an outstanding academic culture with highly trained individuals, and one of these is Luciane Garcez, a Professor of Cultural and Art History. Due to our close working relationship with her we decided to publish articles and publications from time to time (see also our Team section):

- http://www.viajarnahistóriadaarte.com

- http://abca.art.br/httpdocs/entre-tapecaria-de-elke-otte-hulse-e-o-cartao-de-rivane-neuenschwander-luciane-garcez-e-sandra-makowiecky/

28. July 2020: The below article describes a situation on exclusively aplicable to Santa Catarina – the real estate market has become considerably more attractive during the pandemic, due to lower prices and much higher revenues. It turns out that the economic crisis has opened investment opportunities for those who have money to invest – and it is possible to find deals for prices between 40% and 60% lower than the market average. The account is simple: for those who have money to invest, the consultants estimate that it is time to take advantage of the low prices, with an eye on the resumption of the economy.

08. January 2020: The infrastructure investments in Florianopolis are apparently paying off, with an above average valorization of real estate. While the Brazilian trend was an appreciation “swallowed” by inflation, that is, with no real result, six of the seven cities in Santa Catarina evaluated registered positive indexes.

01. October 2019: Today the new airport in Florianopolis was inaugurated. It represents a major developmental leap forward of the region. Some key facts:

- A total investment of R$ 550 million.

- The new airport will be capable of handling 8 million passengers, 4 times its current capacity.

- There will be 120 flights per day. This includes new international flights to Portugal ( Lisbon) and the USA ( Orlando), together with an increased number of flights to Argentina. It is also important for potential clients to know that there are no flight paths over our property, and therefore no noise pollution.

- There will be parking for 2,500 cars. 5 times the current capacity.

- In addition to an extensive range of shops and restaurants, there are plans for concerts, exhibitions, shows and tours.

- Additional Information: https://floripa-airport.com/en/negocios-e-parceiros

12. March 2019: The below summary highlights some of the main advantages to invest in the litoral regions of Santa Catarina, with Balneario Camboriú being a prominent example. Elevated social development and high rates of real estate valuation count among the foremost parameters.

01. July 2019: The state of Santa Catarina in general, with certain hotspots in specific locations like Florianopolis or Joinville, is one of the most developed in terms of infrastructure and tourism development in Brazil. The below article highlights some keynumbers, and also looks at the distribution based on origin of tourists.

São Paulo

São Paulo is the most populous and highest developed state in Brazil. The following article provides demographic, sociological and economic data, published by the School of Economics, Business Administration and Accounting in Ribeirão Preto.

28. November 2025: In this recent edition of the “What you Get” article series of the New York Times three real estate options in São Paulo state were presented, in cooperation with Sotheby´s Brazil as well as Real Estate Brazil/Andreas Hahn:

2. July 2024: São Paulo is frequently associated with a high degree of “verticalization”, that is it is comprised of high buildings with numerous floors and a focus on skyscraper and building construction. It is easy to oversee a development of the recent years which consists of an increasing valuation of houses, private homes and mansions. The following article elaborates on that based on recent research data:

10. May 2024: The gradual lowering of the SELIC rate (Central Bank Interest Rate) in Brazil is having a notable impact on the real estate market, spurring record sales in São Paulo state with the highest dynamics since 2014.

11.08.2023: As part of the Developmental Acceleration Program a new tunnel is being planned connected Santos and Guarujá.

22. September 2022: The ample metropolitan region of Campinas certainly belongs to the economically strongest corners in Brazil, accompanied by high living standards. In São Paulo state it is the region with the highest investment numbers, with almost 17 billion R$ in the first 7 months of 2022.

12. August 2019: The newspaper article refers to the confirmed plan to extend the so-called “Rodoanel Suzano” – Rodoanel Mário Covas (SP-21) , one of the main transit points of São Paulo. It will expand, with new access point. This will alleviate the traffic situation in São Paulo and is one of several major infrastructure projects in Brazil´s largest metropolis. According to real estate analysts this should have an influence on the property market.

Sergipe

Sergipe is a worthwhile place to perform real estate investments. One of the youngest Brazilian states, it offers ample opportunities in sometimes unexplored regions.

Travel Guide and Further Information: https://en.wikivoyage.org/wiki/Sergipe

Statistical and Demographic Information: https://www.ibge.gov.br/en/cities-and-states/se.html

21. October 2021: This short article depicts the growing dynamics in the Brazilian state of Sergipe, with a high and increasing number of investments.

21. August 2021: The trust in the Brazilian economy, even in a post covid scenario, is increasing, as exemplified by the Index of Business Development Trust (Índice de Confiança do Empresário do Comércio (ICEC)) in Sergipe. It has reached its apex during the last 18 months.

8. October 2020: Despite the Corona-Crisis the agricultural sector in Brazil is booming and ever growing. In Sergipe alone, compared to the previous year, the total growth in august was 27 %, which reflects improvements in climatic conditions, productivity and efficiency in management and administration.

9. January 2020: Despite the fact that it is one of Brazil´s smallest states, the agricultural performance of Sergipe is impressive, but also reflecting the general tendencies in Brazil of a growing agricultural economy, with increasing productivity and efficiency. The below article highlights, in an exemplary fashing, the corn harvest of 760.000 tons, which represents a growth of 6,6 % compared to the previous year (2018). One of the variables influencing this outcome is the decrease in the value added tax (ICMS) from 12 % to 2 % for agricultural production in Sergipe, reflecting similar tendencies all over Brazil.

6. September 2019: Sergipe is one of the smallest and equally youngest Brazilian states, established in 1892. However, it is also one of the economically most dynamic and rapidly developping states. Investments in infrastructure have increased recently, and the contract for the concession of the airport of Aracajú, Sergipe´s capital, is one milestone. The article highlights the principal aspects, among them the perspectives of improving the performance of the airport significantly.